(Update - 06.25.20)

In November, CASAA alerted our members to S. 1253, which would prohibit the USPS from shipping vapor products and impose adult signature on delivery requirements for independent carriers like FedEx and UPS. Several months and reams of COVID-19 legislation later, S. 1253 is likely moving back to being fast-tracked through the Senate.

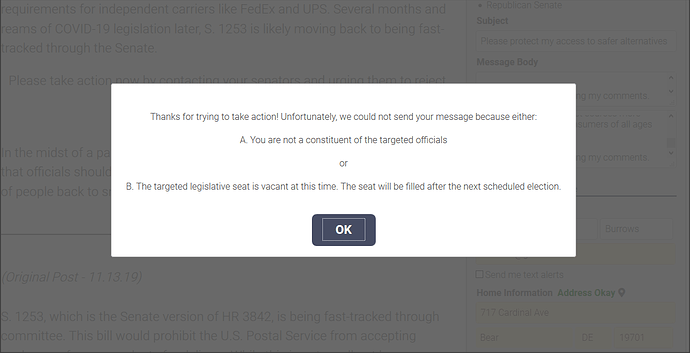

Please take action now by contacting your senators and urging them to reject this bill.

In the midst of a pandemic involving a severe respiratory illness, the last things that officials should be implementing are policies that threaten to send millions of people back to smoking!

(Original Post - 11.13.19)

S. 1253, which is the Senate version of HR 3842, is being fast-tracked through committee. This bill would prohibit the U.S. Postal Service from accepting packages of vapor products for delivery. While this is not an all-out ban on online sales, it would raise the cost of purchasing vapor products for people who depend on being able to have safer alternatives delivered to their door (i.e. people who live in rural areas, people who are unable to be home to sign for deliveries, etc…). The additional cost ranges from $3.00 to $5.00 per package, depending on the shipping company.

While it is understandable that lawmakers want to make it harder for youth to get their hands on nicotine products, this legislation will not address youth access to social sources or illegal sellers on popular social media platforms. In short, all that S.1253/HR.3842 will do is make it more difficult for people to access safer alternatives to smoking. For people living in small towns and urban neighborhoods where vape shops might not exist, this means that cigarettes will remain the most popular and convenient tobacco product.

Please Note: Senate contact forms have a character limit. If you would like to delete what we have provided so you can share your story, please do. Just be aware of the character limit.

- S. 1253 - Bill Page

Did you find this alert helpful? Please consider making a donation to CASAA. We rely on contributions to provide timely information and engagements to help protect everyone’s access to life-saving, low-risk nicotine and tobacco products.

CASAA is 501©(4) tax-exempt organization. While CASAA is a non-profit organization and pays no income taxes on the donations it receives, contributions or gifts to CASAA are not deductible by the donor as charitable contributions for federal income tax purposes.